If they do not correct this, EquityZen will have much bigger problem. If the company IPOs or gets acquired we’ll distribute shares or cash proceeds to you. Receive updates on companies in your portfolio. Jean’s expertise will play a crucial role as EquityZen works to broaden access and. With low investment minimums through its funds and with more than 35,000 private placements completed across 400+. At Zen Equity we are on a mission to simplify equity ownership for all. EquityZen brings together investors and shareholders, providing liquidity to early shareholders and private market access to accredited investors. Track and manage investments and documents. (EquityZen) a leading online marketplace for trading shares of private companies, today announced that Jean Brandolini Lamb joined the firm as Head of Marketing to help drive EquityZen’s continued growth. EquityZen marketplace has made it easy to buy and sell shares in private companies. Fund your investment via ACH transfer or wire. Developer of an investment platform designed to connect shareholders of private companies seeking liquidity with accredited. EquityZen brings together investors and shareholders, providing liquidity to early shareholders and private market access to accredited investors. They do not have integrity in their DNA- in their core values thus the indecision and vacillation. Execute investment documents on EquityZen. To an institution of integrity, this is not a matter of choice - it is an obligation! Right now the matter has been escalated but yet unresolved. Failure to do so, is their immediate liability. It is was entrusted to them to deposit to the designated account stipulated in my profile. First they have to realize that it is my money that they deposited to another account. By making the return of funds a requirement for resending my funds, in effect they are withholding my funds for their mistake. My contention is that the incorrect desposit is their issue, not mine. Their support staff informed me that they will wait or the recall of funds before they will resend my distribution. It was their mistake - they sent the deposit to an account that was not in my business setting. A few days ago they sent a distribution to an incorrect account. or through the competitive latecomers (i.e., EquityZen and Equidate), most pre-IPO ventures have found it convenient to use secondary markets for their. Discounted shares: During a pre-IPO placement, planning, the unlisted or. This is just my perspective, making sure clarify these rules with the company before investing.ĮquityZen is goog but they have an integrity issue.ĮquityZen is great until you have a problem, then the integrity of their management becomes an issue. Event 3: Your RSUs vest and become taxable (180 days after Event 2 ). 16, 2021 /PRNewswire/ - EquityZen, an online marketplace for trading pre-IPO employee shares, today announces the appointment of Eric. With all limitations, it's probably makes sense to take risk on companies that are very near to IPO cycle or companies in latest emerging domain with low valuation. 5) It's very unlikely that employees sell stocks before IPO if that company is doing really good (they/insiders know more than us/outsiders). We can't really trade anything in first 6-months of IPO. 4) For IPO companies - they've 6-months waiting period. Basically to make 10% return that pre-IPO company valuation up by 20%. 3) Charges are high, 5% to buy and 5% to sell. 2) They have express deals to sell, this requires at least 2% ownership. This makes difficult to sell pre-IPO stocks outside equityzen. Few known limitations (please verify with your sales person) - 1) There is NO real ownership of stocks, basically we own percentage in Equityzen-series LLC and that LLC owns stocks. View source version on businesswire.They have reasonable deals but it only works well for companies with clear IPO plan.

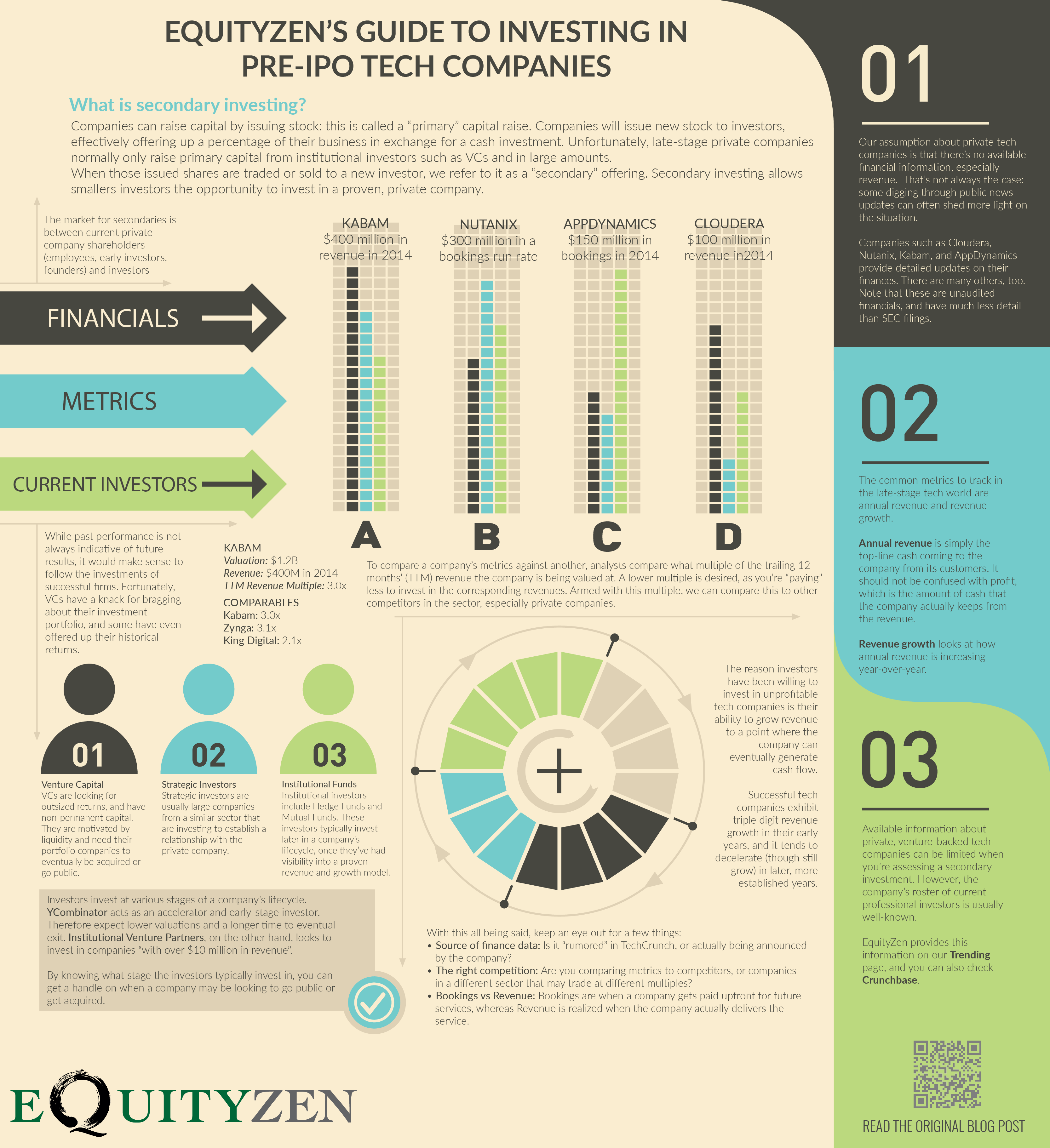

With low investment minimums through our funds and with more than 35,000 private placements completed across 400+ companies, EquityZen leads the way in delivering "Private Markets for the Public." Similar companies and competitors in the areas of Fintech, SaaS, TMT, Capital Raising, Finance, Financial Services, Payments and.

Since 2013, the EquityZen marketplace has made it easy to buy and sell shares in private companies. "I’m thrilled to join this talented team to drive future business growth by opening access to the private markets for the benefit of both shareholders and investors."

"EquityZen’s mission of democratizing access to the private markets as well as the company’s brilliant yet humble leadership attracted me to this amazing company," said Jean Brandolini Lamb, Head of Marketing at EquityZen.

0 kommentar(er)

0 kommentar(er)